There’s also a welcome bonus of a $200 statement credit after spending $2,000 on purchases within the first 6 months.Īlthough the elevated earnings rate on online purchases is capped, you might end up ahead on your total spending due to the higher cash-back earnings on gas and groceries. Cash back is received in the form of Reward Dollars that can be easily redeemed for statement credits. (on up to $6,000 in each category per year in purchases, then 1%), and 1% cash back on other purchases. gas stations, and online retail purchases in the U.S. If you’re an online shopper but not necessarily loyal to PayPal specifically, the Blue Cash Everyday® Card from American Express (Terms apply. Blue Cash Everyday® Card from American Express Rewards come as Chase Ultimate Rewards®, a highly flexible currency that can be redeemed for cash back, travel, gift cards, merchandise or combined with rewards earned from a Chase Sapphire Preferred® Card or Chase Sapphire Reserve® card and transferred to one of Chase’s travel transfer partners. For an annual fee of $0, the card earns 5% cash back on up to $1,500 in categories that rotate quarterly (requires activation), 5% on travel purchased through Chase Ultimate Rewards®, 3% on dining and drugstores and 1% on all other purchases.

If you’re looking for an all-purpose card that earns elevated rewards across a broad swath of categories, the Chase Freedom Flex℠ * could be the needle in the haystack you’ve been searching for. After that, the fee will be 5% of each transfer (minimum $5). An intro balance transfer fee of either $5 or 3%, whichever is greater, applies to transfers completed within the first 4 months of account opening. After that, the standard variable APR will be 18.99% - 28.99%, based on creditworthiness. Those points can thus potentially redeem for more value.Īlso worth noting is the Double Cash’s offer of a 0% intro APR on balance transfers for 18 months. One benefit of the Double Cash card, however, is that the rewards come as ThankYou points, which can be taken as cash back, used to book travel transferred to Citi’s airline transfer partners. The most direct competitor to this card is the Citi® Double Cash Card, which earns 2% cash back on all purchases-1% when purchases are made and another 1% when they’re paid off.Īlthough the two may-at first-seem nearly identical, there are a few differentiating features that will make one or the other a better fit for you. This is in addition to the first year welcome bonus. Based on those numbers, a household that charges everything to the PayPal Cashback Mastercard would earn at least $641 in rewards each year, more if you can use PayPal to make your purchases. The 70th percentile of wage-earning households bring in $107,908 annually and spends $32,072 on credit card purchases. Rewards Potentialįorbes Advisor uses data from various government agencies in order to determine both baseline income and spending averages. Because of this, you’ll need to keep your PayPal account open and in good standing in order to hold onto the card. There are no options to convert your rewards to statement credits, gift cards or to book travel. To redeem your rewards, you’ll transfer them to your PayPal account, where they can be used toward PayPal purchases or transferred to a linked bank account. Your rewards are calculated each day, and you can redeem them in any amount, with no minimum thresholds. Redeeming rewards with this card is just as easy as earning them. This card does not offer a welcome bonus. That makes this card a great choice for someone who values simplicity. There are no categories to keep track of and no limits to how much you can earn.

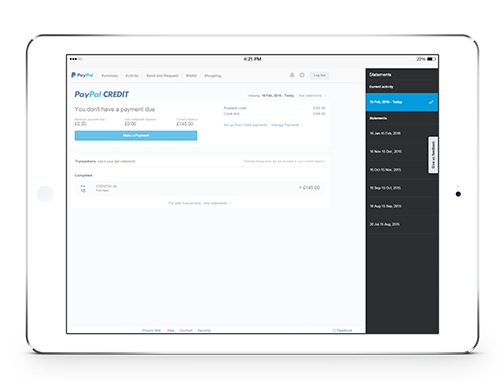

Rewards on this card are uncomplicated, since you’ll earn a flat 3% cash back when checking out with Paypal and 2% on all other purchases made online or in-store.

0 kommentar(er)

0 kommentar(er)